tax relief malaysia 2019

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Taxpayers or by foreign entities in which US.

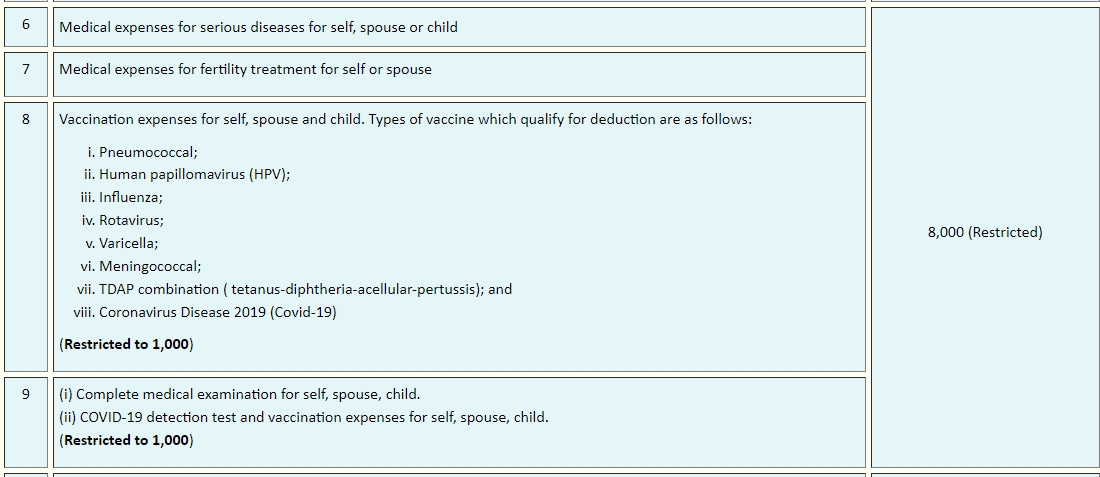

Malaysia Personal Income Tax Relief 2021

An individual employed in Malaysia is subject to tax on income arising from Malaysia regardless of where the employment contract is signed or the.

. IRS further extends deadline to file 20192020 tax returns for penalty relief in disaster areas. No other taxes are imposed on income from petroleum operations. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations and FFI agreement if applicable or comply with the FATCA. Govt To Reduce Individual Tax Rates For Two Income Brackets By 2. In 2019 the sector contributed about 159 per cent to the total GDP.

In mid-April 2019 the Coalition government announced that it would. Tax pros and taxpayers now have more time to file certain 2019 and 2020 returns to get late-filing penalty relief. Call our Customer Careline at 1-300 88 6688 Malaysia or 603-7844 3696 Overseas.

The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. Taxation of light fuel oil for households per litre. For all other back taxes or previous tax years its too.

Taxpayers hold a substantial ownership interest. Conditional waiver of surcharges for instalment settlement of demand notes for the Years of Assessment 201920. Income Tax Slab for Financial Year 2019-20.

Malaysia has imposed capital gain tax on share options and share purchase plan received by employee starting year 2007. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. News email and search are just the beginning.

Double Taxation Relief for companies. ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL. Everything You Should Claim For Income Tax Relief Malaysia 2021 YA 2020 Jacie Tan - 12th March 2021.

Year of Assessment 20132014. Foreign tax relief. Petroleum income tax.

Income Tax for Year of Assessment 2019 AND latest Income Tax Assessment. According to the World Tourism Organization Malaysia was the fourteenth-most visited country in the world and the fourth-most visited country in. 20 May 2019 International treaty.

Malaysia m ə ˈ l eɪ z i ə-ʒ ə. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. In relation to WHT from 1 January 2019 to the UKs DTTs with those territories that have also ratified before 1 October 2018 where those are covered tax agreements.

The ATA Carnet often referred to as the Passport for goods is an international customs document that permits the tax-free and duty-free temporary export and import of nonperishable goods for up to one year. For example you have until April 15 2024 to claim a 2020 Tax Refund April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022. Finally list down the employees details for the current month.

Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID disease. It is a globally accepted guarantee for customs. This is the income tax guide for the year of assessment 2019.

Malaysia Residents Income Tax Tables in 2022. FATCA requires foreign financial institutions FFIs to report to the IRS information about financial accounts held by US. Capital Gains Tax rose.

Identify the Terms Conditions to Calculate PCB Where to deduct the PCB amount from. If you are filing your taxes Related articles. Updated as of 15 September 2022.

Employment income - Gross income from employment includes wages salary remuneration leave pay fees commissions bonuses gratuities perquisites or allowances in money or otherwise arising from employment. Maximum RM 4000 relief per year. Chapter 18 also deals with the tax relief provided to the companies in lieu of the charitable.

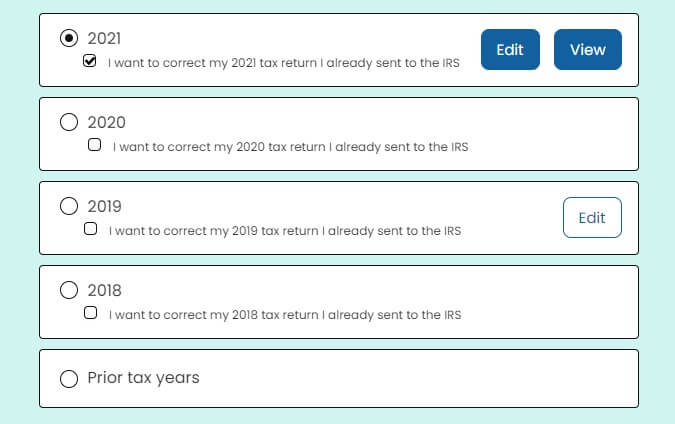

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Self-Employed defined as a return with a Schedule CC-EZ tax form. How To File Your Taxes For The First Time.

1 online tax filing solution for self-employed. In my recent article IRS provides automatic relief for late filed 2019 and 2020 returns and penalties paid to be refunded I described the penalty relief granted to taxpayers for late-filed 2019 and 2020 returns that were filed by September 30 2022. Tax Exemptions in respect of Relief Measures under the Anti-epidemic Fund.

The spending primarily includes 300 billion in one-time cash payments to individual people who. Tax pros and taxpayers now have more time to file certain 2019 and 2020 returns. Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due date or deadline.

Everything You Should Claim For Income Tax Relief Malaysia 2021 YA 2020 How To File Your Taxes For The First Time. Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai Konsultasi Awam. Discover more every day.

Thresholds under which there is relief from VATGST registration and collection as well as information on minimum registration periods etc. Americas 1 tax preparation provider. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

Tax policy responses to COVID-19. Prepare more tax returns with greater accuracy and efficiency with TaxWise tax preparation software. The income tax slab is a slab under which an individual fall is determined based on the income earned by an individual.

Taxation of automotive diesel per litre - 2019. The precise dates on which the MLI will begin to have effect for other purposes or in relation to other DTTs will depend upon. Taxation of premium unleaded gasoline per litre - 2019.

For my 2019 return I was considered as. IRS further extends deadline to file 20192020 tax returns for penalty relief in disaster areas. Maybanks Financial Relief Scheme.

It began to apply eg. It consists of unified customs declaration forms which are prepared ready to use at every border crossing point. One man is hiking over 4800 miles across America to raise awareness for breast cancer.

Would lead to a bulk selling of assets just before the start of the 200809 tax year to benefit from existing taper relief. IRS provides tax-return-filing and payment relief for. Individuals whose income is less than Rs25 lakh per annum are exempted from tax.

Tax Planning For 2019 Malaysia Get It Done Now Be Better

Covid 19 Outbreak In Malaysia Actions Taken By The Malaysian Government Sciencedirect

2 Update On The Tax Measures Introduced During The Covid 19 Crisis Tax Policy Reforms 2021 Special Edition On Tax Policy During The Covid 19 Pandemic Oecd Ilibrary

Newsletter 39 2019 Income Tax Exemption No 8 Order 2019 Page 001 Jpg

Paid For Covid 19 Rt Pcr And Self Test Kits In 2021 You Can Claim Tax Relief Up To Rm1 000 Soyacincau

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Iproperty Com My

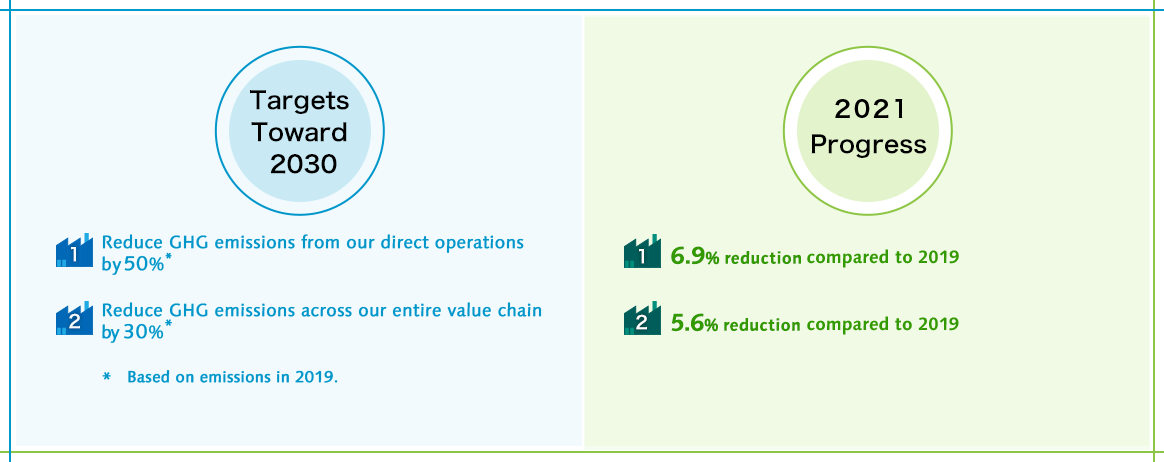

Suntory Sustainability Data Sheet Major Sustainability Data

9 Income Tax Ideas Income Tax Tax Income

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

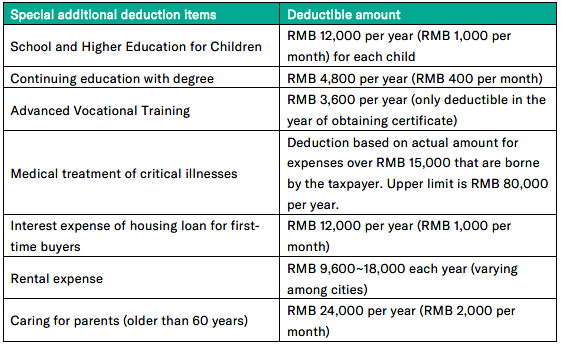

Income Tax Reliefs Rebates For Individual Year 2019

Irb To Provide Tax Relief For Covid 19 Test And Vaccination Of Up To Rm1 000

2022 Malaysian Income Tax Calculator From Imoney

Deadline To File Income Tax 2019 Malaysia

All Posts In The Month Of 2020

The Revolution In China Individual Income Tax Law As Of 2019 Rodl Partner

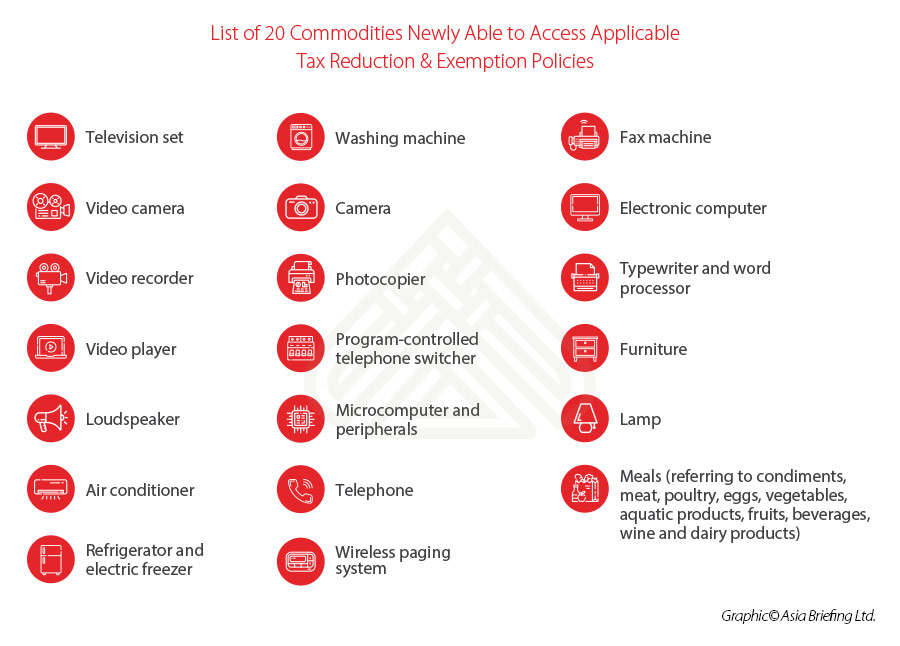

China Reinstates Import Tax Reduction And Exemption For 20 Commodities

2019 Banking Industry Outlook Deloitte

Doing Business In The United States Federal Tax Issues Pwc

0 Response to "tax relief malaysia 2019"

Post a Comment